In the past few years, UBC regional councils have begun an innovative program of grassroots ownership activism, as a complement to the national ownership activism. The grassroots activism puts a local “face” on the UBC’s national activism, infuses it with new energy, and sharpens the focus on the interests of the full range of corporate stakeholders, including employees, communities, and owners. UBC Council representatives in their roles as corporate owners, workers, community members, and corporate customers, are uniquely positioned to monitor corporate actions and advocate for necessary reforms.

UBC members’ retirement security is dependent on solid Fund investment returns, as well as upon growing employment-related contributions to the Funds. The grassroots activism agenda is vital to the goal of retirement security in that it advances a corporate governance model that supports a long-term corporate management perspective with an emphasis on job growth, innovation, and a rising standard of living. National and regional economic growth is important to support an increasing level of quality employment opportunities for workers. Economic growth is dependent on innovative and growing companies. To this end, the UBC grassroots activism program is an important monitor of regional corporations, their governance practices, and their operations in the communities where UBC members work and live.

The program activities undertaken to accomplish the program goals of enhancing members’ retirement and employment security include the following:

Anticipated future activities include interaction with the representatives of the state public-employee pension funds maintained in a Council’s jurisdiction to advance common corporate ownership goals. Also, opportunities will present themselves to explore interactions with the monitored corporations on important state and federal legislative issues.

Over the course of the past several proxy seasons, UBC Council representatives in the Eastern District’s North Atlantic States Regional Council of Carpenters, New York City District Council, and the Eastern Atlantic States Regional Council of Carpenters have attended nearly one-thousand corporate annual shareholder meetings held by two-hundred and fifty separate corporations headquartered in their Council’s jurisdiction to engage the boards and senior executives of those companies on a variety of key governance issues. Representatives of the Midwestern Council’s Indiana/Kentucky/Ohio Regional Council, Chicago Regional Council, St. Louis/ Kansas City Regional Council, Michigan Regional Council and the North Central States Regional Council joined the grassroots activism program attending nearly one hundred and fifty “virtual” shareholder meetings during the Covid-19 pandemic, extending the UBC grassroots program beyond its origins in the Northeast.

I’m Derek Adamiec, a representative for the North Atlantic States Regional Council of Carpenters and I just came from the State Street Corporation annual meeting in Boston, which I’ve attended for several years. At the meeting I represent the national stockownership of all the UBC pension plans in State Street. At these meetings, I’ve had the opportunity to ask the board chairman and chief executive officer about important corporate governance issues, such as majority voting for directors, audit firm independence, and executive compensation issues. As long-term owners, we look to be supportive of those companies with solid corporate governance and a solid long-term strategic business plan. I think our engagement with these companies helps them and it strengthens the performance of our funds’ investments.

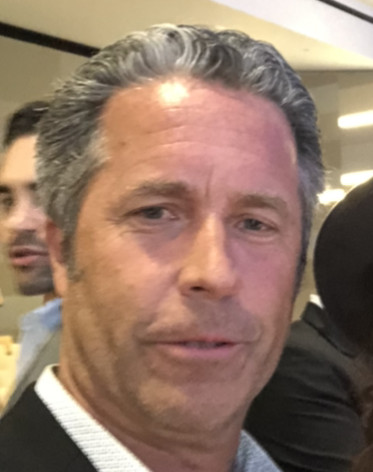

My name is Gerry Matthews, a representative for the New York City District Council and I have the opportunity to represent the UBC at some of the largest corporations in America here in New York City. You have Goldman Sachs, Morgan Stanley, JPMorgan Chase and others. One of the most important roles we can play is to monitor the executive compensation of the senior executives of these corporations. Executive compensation has escalated to levels that the average working man or woman find hard to justify. We critically examine salary levels, annual incentives and long-term bonuses, and any severance or retirement benefits awarded senior executives. We work hard for our pay every day, and we want to make sure these executives are earning theirs.

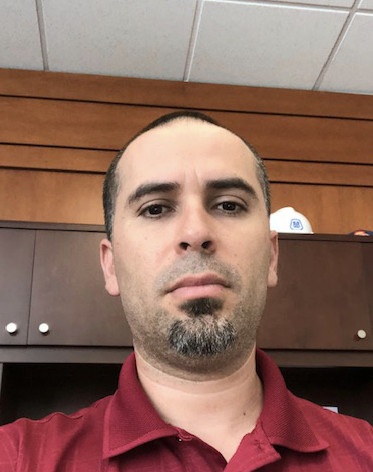

I’m Raul Ramirez a representative with the Eastern Atlantic States Regional Council of Carpenters and I was just at a shareholder meeting of a large real estate investment trust company that owns office buildings in this market. I had an opportunity to talk with company personnel about fair contracting policies. The health of our pension funds depends in large measure on the hours of work our members are able to put in. Many of these real estate companies are influential participants in the construction market, so it is important to develop a good working relationship and lines of communications with these large area corporations. Our members’ pension funds that are established with signatory contractors purchase the stock of companies like these, so it is important that they know that and that we establish a working relationship with them.